Slippage is the bane of any trader’s existence. According to Investopedia, Slippage often occurs during periods of high volatility; resulting in a difference between the expected price of a trade, and the price the trade actually executes at.

The Leo EA uses an averaging method of placing positions at increasing weight, so that the buy line moving average will drop & all positions can close for a profit if the market turns up just slightly (and vice versa for short positions).

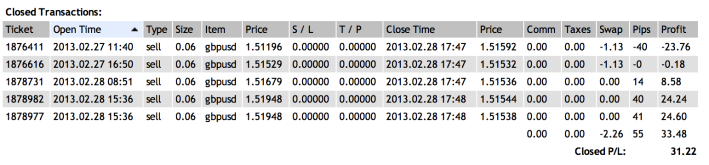

The robot automatically closes all positions when they average out to a 35pips profit, and doesn’t pose much of a problem if the total lots I’m holding is less than 1 lot, and each position is small (less than 0.1 lot).

But when my total lot size goes over 1 lot, the new positions placed are exponentially larger. Any small fluctuation in prices when the EA reaches take profit level of 35pips (as you can see below), could end up in a 100-500pips loss.

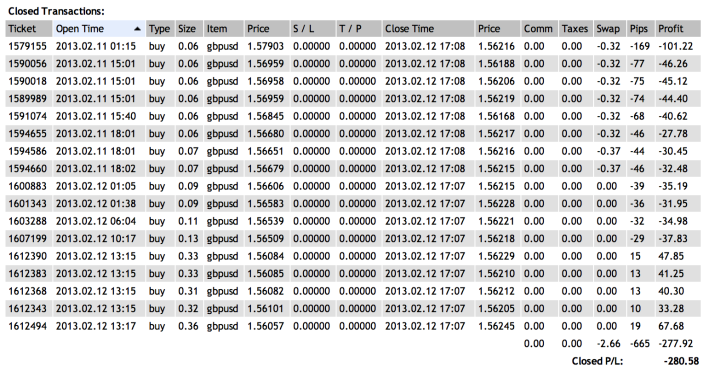

On the 11th & 12th of Feb 2013, 3 of my 5 accounts faced the problem of closing at losses due to volatile market conditions, losing between 2.8% to 4% within 1 day! I was very concerned and after speaking to Edward, found out that many other clients had the same problem, even on other brokers.

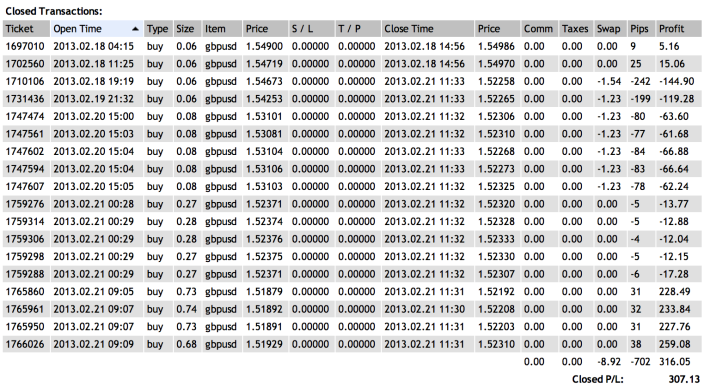

Then just 10 days later on the 21st of Feb 2013, 4 accounts dropped 1.5% to 2.3%, while the last 1 account made 3% due to the volatile market conditions during basket closing of positions (see below).

This is very unfortunate & I am concerned about the increasing frequency of volatile marketing conditions leading to loss, especially with this method of Auto trading.

This is very unfortunate & I am concerned about the increasing frequency of volatile marketing conditions leading to loss, especially with this method of Auto trading.

Although it does not happen often, I am losing my confidence in the ability of the EA to generate consistent profits, for the sole reason that slippages like this can cause an extremely unfavourable and unpredictable loss anywhere from 1% up to 5% of my investment (or even more who knows!).

Just off the top of my mind, could there be a way to overcome this by increasing the current take profit from 35 pips? I would imagine this will in turn increase the risk factor, which would then have to be counter balanced by something else… such as trading on a higher time frame like M15 or M30 instead of the current M5 chart?

Feel free to leave your comments and thoughts on this!